Sealless Pumps for a Safer and Greener World

In the dynamic landscape of industrial applications, chemical pumps play a pivotal role in the safe and efficient transport of various fluids, including corrosive and viscous substances. The global chemical pump market is anticipated to reach a valuation of approximately $5.1 billion by 2025, growing at a 4.8% from 2020 to 2025, according to a report by MarketsandMarkets. This growth can be attributed to rising demand from sectors such as pharmaceuticals, oil and gas, and chemicals themselves, where reliability and performance are paramount.

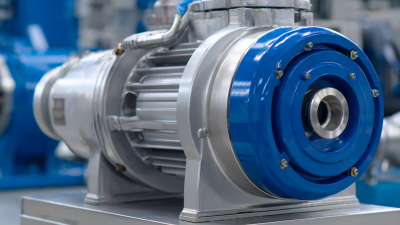

As industries strive for enhanced productivity and sustainability, selecting the right type of chemical pump becomes crucial. Various pump types—including diaphragm, centrifugal, and gear pumps—offer distinct advantages tailored to specific applications. For instance, diaphragm pumps are especially suited for handling hazardous materials, effectively minimizing the risk of leaks and spills. Conversely, centrifugal pumps are favored for their efficiency in transferring large volumes of fluids.

This article outlines the top ten chemical pumps for industrial applications in 2023, emphasizing their functionalities, advantages, and suitability for diverse environments, thereby equipping industry professionals with the insights needed to make informed decisions.

As we explore the landscape of chemical pump technology in 2023, several key trends are emerging that are shaping the future of industrial applications. One of the most significant trends is the increasing emphasis on energy efficiency. Manufacturers are developing pumps that not only reduce energy consumption but also enhance performance, allowing industries to meet their sustainability goals without compromising productivity. This focus on efficiency is driving the adoption of advanced materials and designs that minimize wear and improve longevity.

Another critical trend is the integration of smart technology into chemical pumps. The rise of the Internet of Things (IoT) allows for real-time monitoring and control of pump operations, enabling predictive maintenance and reducing downtime. This technology empowers operators to access data remotely, leading to more informed decision-making and optimal performance. Moreover, advancements in automation are streamlining chemical handling processes, making them safer and more efficient. As industries continue to prioritize safety and reliability, these smart solutions are becoming indispensable in modern chemical processing.

In 2023, the landscape of chemical pumps for industrial applications has evolved significantly, driven by advances in technology and changing market demands. A comparative analysis of the leading models reveals key performance metrics that distinguish the top contenders. Essential factors such as flow rate, efficiency, material compatibility, and maintenance requirements are critical in evaluating these pumps.

One standout model demonstrates an optimal balance between high flow rates and energy efficiency, making it ideal for operations that require consistent performance with lower operational costs. Additionally, the materials used in pump construction have seen significant improvements, ensuring resistance to corrosive chemicals and prolonged service life. Meanwhile, some models are designed for easy maintenance, minimizing downtime and allowing for cost-effective operations in the long run.

The importance of these performance metrics cannot be overstated, as industries seek to enhance productivity while ensuring safety and compliance with environmental regulations. By focusing on these criteria, companies can make informed decisions that align with their operational goals and improve overall efficiency.

In 2023, the selection of chemical pumps for industrial applications increasingly hinges on energy efficiency, reflecting broader trends toward sustainability and cost-effectiveness in manufacturing. As energy prices fluctuate and environmental regulations become stricter, companies are compelled to consider the operational costs associated with pump systems. Higher energy efficiency translates to reduced electricity consumption, which not only lowers operational costs but also minimizes the carbon footprint of industrial processes.

Moreover, advancements in technology are facilitating the development of more energy-efficient pump designs. Manufacturers are investing in innovative materials and designs that enhance pump performance while consuming less energy. This trend not only caters to the growing demands for environmentally friendly solutions but also positions companies to remain competitive in an increasingly eco-conscious market. As a result, businesses are more likely to prioritize energy-efficient pumps that meet their operational needs while contributing to sustainability goals. In this dynamic landscape, the effective balance of performance and energy efficiency is vital for successful chemical pump selection in 2023.

In 2023, advancements in material science have significantly enhanced the durability and performance of chemical pumps used in various industrial applications. As industries increasingly demand reliability and efficiency, the focus has shifted towards the development of advanced materials that can withstand harsh chemicals and extreme working conditions. For instance, the adoption of high-performance polymers and composite materials has surged, enabling chemical pumps to resist corrosion and wear, thus extending their operational lifespan. According to a recent market report by Research and Markets, the global chemical pump market is expected to reach $8.5 billion by 2025, driven by these technological innovations.

Furthermore, advancements in 3D printing technology have facilitated the creation of custom-designed pump components that reduce material waste while enhancing performance. This allows manufacturers to produce pumps tailored to specific applications, resulting in improved efficiency and reduced downtime. A study by Grand View Research indicates that the introduction of innovative materials could lead to a 30% increase in pump lifespan, optimizing maintenance schedules and reducing operational costs for industries reliant on chemical transfer.

As the sector continues to evolve, these material innovations will play a crucial role in meeting the growing demands for both sustainability and efficiency in chemical processing.

The chemical pump market is poised for substantial growth over the next few years, driven by increased demand across various industries. The market is forecasted to expand significantly, reflecting an uptick in applications from sectors such as pharmaceuticals, petrochemicals, and water treatment. Reports indicate that chemical pumps will play a critical role in optimizing system efficiencies and enhancing operational reliability, further boosting their appeal in industrial settings.

By 2025, specific segments of the pump industry, such as the AODD (Air-Operated Double Diaphragm) pump market, are expected to grow from a valuation of $250 million in 2022 to approximately $385 million by 2030, driven by a compound annual growth rate (CAGR) of 6.5%. Meanwhile, the global micro pump market shows even more promising growth, with projections indicating an increase from $3.03 billion in 2025 to $5.17 billion by 2032, achieving a notable CAGR of 7.9%. This upward trend signifies a robust demand for efficient fluid handling solutions, making chemical pumps a vital component in future industrial developments.

| Rank | Pump Type | Max Flow Rate (GPM) | Max Pressure (Psi) | Material Compatibility | Projected Market Growth (2023-2025) |

|---|---|---|---|---|---|

| 1 | Diaphragm Pump | 100 | 150 | Acids, Alkalis | 7% CAGR |

| 2 | Centrifugal Pump | 400 | 250 | Water, Oils | 5% CAGR |

| 3 | Positive Displacement Pump | 200 | 500 | Viscous Fluids | 6% CAGR |

| 4 | Gear Pump | 300 | 200 | Heavy Oils, Chemicals | 8% CAGR |

| 5 | Peristaltic Pump | 50 | 100 | Slurries, Powders | 10% CAGR |

| 6 | Lobe Pump | 250 | 300 | Food Grade, Dairy | 6.5% CAGR |

| 7 | Multipurpose Pump | 350 | 400 | Chemicals, Fluids | 7.2% CAGR |

| 8 | Submersible Pump | 100 | 150 | Water, Wastewater | 4% CAGR |

| 9 | Chemical Injection Pump | 60 | 200 | Corrosive Chemicals | 9% CAGR |

| 10 | Magnetic Drive Pump | 120 | 250 | Hazardous Materials | 8.5% CAGR |